- CQF Program

- Events

- Resources »

- Membership

- Careers »

- About Us »

Open Filter

Congratulations to the Newest CQF Program Graduates

The Certificate in Quantitative Finance (CQF) is proud to introduce the latest program graduates. This is the 44th cohort of delegates to successfully complete the qualification.

Thu 3 Apr 2025

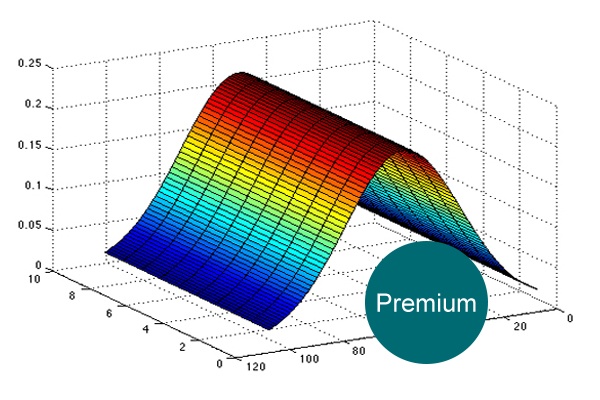

FX Volatility Smile Construction

The foreign exchange options market is one of the largest and most liquid OTC derivative markets in the world. Surprisingly, very little is known in the academic literature about the construction of the most important object in this market: The implied volatility smile.

Wed 27 Nov 2024

A Market Model of Interest Rates With Dynamic Basis Spreads in the Presence of Collateral and Multiple Currencies

The recent financial crisis caused dramatic widening and elevated volatilities among basis spreads in cross-currency as well as domestic interest rate markets.

Fri 22 Nov 2024

CQF Celebrates Another Record-Breaking Number of Graduates

The Certificate in Quantitative Finance (CQF) is proud to introduce the latest program graduates. This is the 43rd cohort of delegates to successfully complete the qualification and celebrates a record-breaking number of graduates to complete the program.

Thu 7 Nov 2024

Methods for Constructing a Yield Curve

In this paper we survey a wide selection of the interpolation algorithms that are in use in financial markets for construction of curves such as forward curves, basis curves, and most importantly, yield curves.

Sun 3 Nov 2024

Quantpedia Research Review - Issue 23

Issue 23 revisits Bitcoin Trend-following and Mean-reversion strategies, assessing performance from November 2015 to August 2024 amid market shifts. It also explores enhancing commodity momentum with an intra-market correlation filter and examines a study on the impact of monetary policy and risk sentiment on crypto asset prices.

Thu 31 Oct 2024

Robust and Stable Capital Allocation

Capital allocation of credit risk is one of the key concepts of modern value based bank management. In order to conduct business decisions according to some risk-reward relationship the reliability of capital allocation figures on transaction level is most critical.

Mon 21 Oct 2024

Callable Swaps, Snowballs, and Videogames

Although economically more meaningful than the alternatives, short rate models have been dismissed for financial engineering applications in favor of market models as the latter are more flexible and best suited to cluster computing implementations.

Fri 18 Oct 2024

Multivariate Smiling

The paper presents an application of the Variance-Gamma distribution to price multivariate derivatives. The paper focuses on the practical implementation of the model in a multivariate setting.

Sat 5 Oct 2024

Quantpedia Research Review - Issue 22

Issue 22 explores machine-learning-based trading strategies, noting their potential for positive net returns despite high costs. It also examines the long-term outperformance of equal-weighted benchmark portfolios over market-cap-weighted ones and introduces the P-CAPE ratio, which includes the dividend payout ratio to enhance return estimations.

Mon 30 Sep 2024

Dynamic Hedging is Dead! Long Live Static Hedging!

We consider the pricing of options in a mean-variance framework in the complete absence of any dynamic (delta) hedging. We describe the concept, and how to reduce risk by static hedging only, in both stochastic volatility and jump-diffusion models, giving some results for the latter.

Mon 30 Sep 2024

Classification vs. Regression in Crisis Prediction

Predicting financial crises is a complex yet crucial task for investors, economists, and policymakers.

Thu 19 Sep 2024

Fast Estimation of American Bond Option Prices

This paper presents a fast way to approximate prices of American bond options by Monte Carlo simulation.

Thu 12 Sep 2024

The Importance of being Global. Application of Global Sensitivity Analysis in Monte Carlo Option Pricing

Monte Carlo and Quasi Monte Carlo methods for pricing European and Asian call options are compared.

Sun 1 Sep 2024

Extended Credit Grades Model with Stochastic Volatility and Jumps

We present two robust extensions of the CreditGrades model: the first one assumes that the variance of returns on the firm’s assets is stochastic, and the second one assumes that the firm’s asset value process follows a double-exponential jump-diffusion.

Tue 27 Aug 2024

Quantpedia Research Review - Issue 21

Issue 21 explores Martingale betting systems, investigates the lead-lag effect of similar ticker symbols, and explains how to design a robust trend-following system.

Tue 20 Aug 2024

Pricing with Jump Signals in the PDE Framework

In this paper we discuss the practical implementation of jump models in a partial differential equation framework for pricing derivatives under a known and unknown number of jumps, regime changes, and reorganization.

Sat 17 Aug 2024

Monte Carlo Simulation of Long-Term Dependent Processes: A Primer

This article briefly describes the Cholesky method for simulating Geometric Brownian Motion processes with long-term dependence, also referred as Fractional Geometric Brownian Motion.

Thu 8 Aug 2024

Steering a Bank Around a Death Spiral: Multiple Trigger CoCos

In this paper we start with the introduction of two pricing models to value contingent convertibles. One model (“rule of thumb”) has its roots in credit derivatives pricing while the second model implements an equity derivatives approach.

Fri 26 Jul 2024

Quantpedia Research Review - Issue 20

Issue 20 explores the efficacy of active versus passive life cycle savings strategies by comparing multiple asset classes, examines the innovative use of Convolutional Neural Networks (CNNs) for pairs trading, and analyzes financial analysts' counter-cyclical views on risk premia.

Tue 16 Jul 2024

Optimal Trading in the Presence of Economic Events

In this article, the author explores the problem of optimal buy/sell strategies in the presence of economic events.

Fri 14 Jun 2024

Quantpedia Research Review - Issue 19

Issue 19 explores the use of Google Trends data to predict cryptocurrency returns, discusses the influence of business cycles on machine learning stock predictions, and studies an analysis of currency market strategies over a 200-year history.

Tue 11 Jun 2024

Calculating Value-at-Risk Using Option Implied Probability Distribution of Asset Price

In this article, the author uses the probability distribution of asset prices extracted from option prices to get the VaR of a portfolio using Monte-Carlo method.

Fri 10 May 2024

What Salary Could You Earn Working in Quantitative Finance?

Embark on your quant finance career journey with the 2024 CQF Careers Guide to Quantitative Finance.

Tue 7 May 2024

Quantpedia Research Review - Issue 18

Issue 18 delves into cryptocurrency hedging strategies, discusses the impact of Bitcoin’s future expiration on prices, and explores the role of art as a portfolio diversifier.

Wed 24 Apr 2024

The Heston–Hull–White Model Part I: Finance and Analytics

This is the first article in a series of three on financial modeling. The aim of this series is to show the full life cycle of model development. We have chosen an equity model with stochastic volatility and stochastic interest rates.

Fri 5 Apr 2024

Negative Probabilities in Financial Modeling

The article explores the concept of negative probabilities and how they can be used in financial modeling, specifically in the valuation of certain financial options known as Caps and Floors.

Wed 3 Apr 2024

Quantpedia Research Review - Issue 17

Issue 17 delves into stock market concentration in the United States, discusses how to improve portfolios using mutual information, and explores the robust testing of country and asset ETF momentum strategies.

Mon 25 Mar 2024

American π: Piece of Cake?

Textbooks tell you that pricing an American option in the context of the binomial model is a lot easier than it sounds. Is it really simple and obvious? Yes…and no.

Wed 21 Feb 2024

Julia Computing: Automatic for the Greeks

In this article, Dr. Simon Byrne and Dr. Andrew Greenwell discuss fast and accurate price sensitivities using Julia.

Wed 21 Feb 2024

Quantpedia Research Review - Issue 16

Issue 16 introduces a new Pragmatic Asset Allocation Model, highlights the critical role of machine learning model execution time in empirical asset pricing, and explores if factor risks can explain crypto market returns.

Wed 21 Feb 2024

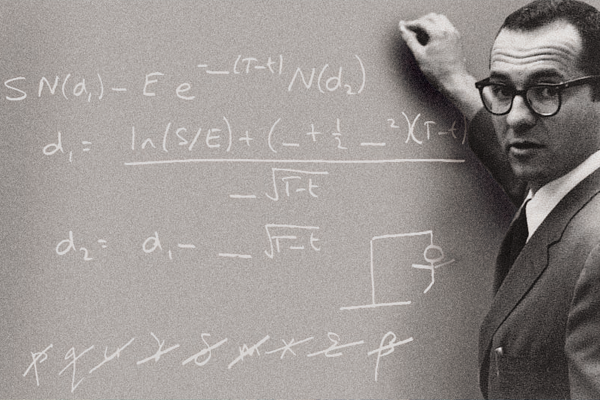

Time and Black–Scholes–Merton

The article contrasts the abstract nature of financial models like Black–Scholes–Merton with their application in real-world markets, highlighting the philosophical challenges of reconciling formal mathematical constructs with physical time and history.

Tue 23 Jan 2024

Peter Carr's Hall of Mirrors

Put-call symmetry may have been the start but, for Peter Carr, the importance of invariance extends into surprising realms of possibility. Dan Tudball traces Carr’s kaleidoscopic journey…

Tue 23 Jan 2024

Quantpedia Research Review - Issue 15

Issue 15 delves into the intricate relationship between cybersecurity risk and stock performance, discusses how inflation affects equity returns, and explores why US stocks outperform emerging and developed markets.

Tue 23 Jan 2024

Close Encounters of the Third Order

The article discusses third-order implied volatility approximations for option pricing, as presented by Matt Lorig and colleagues, drawing a cultural parallel with the film "Close Encounters of the Third Kind."

Thu 14 Dec 2023

Grid Monte Carlo in Portfolio CVA Valuation

This article proposes and discusses an efficient numerical technique, Grid Monte Carlo (GMC), for the risk-neutral valuation of portfolio CVA.

Thu 14 Dec 2023

Quantpedia Research Review - Issue 14

Issue 14 discusses the impact of financial influencers on market sentiment, the effectiveness of machine learning models in predicting stock returns with reduced biases, and the challenges of maintaining profitable machine learning strategies in increasingly efficient markets.

Thu 14 Dec 2023

The Heston–Hull–White Model Part II: Numerics and Examples

In this article, the authors review the methods for pricing European options using the Heston-Hull-White model.

Wed 15 Nov 2023

Optimal Hedging Strategies With an Application to Hedge Fund Replication

In this paper, the authors discuss the technical challenges of implementing a multivariate extension of Dybvig (1988) model and discuss the possible solutions.

Wed 15 Nov 2023

Quantpedia Research Review - Issue 13

Issue 13 examines the strategies of Time Invariant Portfolio Protection, discusses how different investors and their strategies influence anomaly returns, and revisits the potential of OpenAI's ChatGPT for backtesting.

Wed 15 Nov 2023

CQF Program Celebrates its 20th Anniversary with Record-Breaking Number of Graduates

The Certificate in Quantitative Finance (CQF) program has double the reason to celebrate this year. Not only does this year mark the CQF's 20th anniversary, but also the highest number of CQF delegates in the program's two-decade history have successfully graduated in the most recent cohort.

Mon 23 Oct 2023

Primer on Arbitrage and Asset Pricing

In this paper, the authors go back to basics with arbitrage and asset pricing.

Thu 19 Oct 2023

CDOs in Chains

In this paper, the authors explore the pricing of CDOs in a Markov chain framework.

Thu 19 Oct 2023

Quantpedia Research Review - Issue 12

Issue 12 explores seasonal patterns related to Bitcoin, investigates the diversification potential of commodities, and discusses how machine learning can be used in quantitative trading.

Thu 19 Oct 2023

Quantpedia Research Review - Issue 11

Issue 11 explores technical analysis patterns, investigates long-short anomaly portfolio return predictability, and discusses the performance of factor strategies in India.

Fri 29 Sep 2023

An Introduction to the Generalized Marginal Risk

In this paper, the authors present the concept of generalized marginal risk.

Fri 22 Sep 2023

The Value of Liquidity

In this article, the authors present a game-theoretic example that helps to illustrate the value of liquidity.

Tue 22 Aug 2023

Quantpedia Research Review - Issue 10

Issue 10 discusses how beta adjusting equity factor leads to better strategies, explores the top models for Natural Language Understanding (NLU), and provides an analysis of factor investing funds.

Tue 22 Aug 2023

Improving the Initial Margin Model

Stuart Smith examines ISDA’s response to the PRA’s comments of SIMM and explores the implications of this for the derivatives market.

Wed 19 Jul 2023

The Implied Loss Surface of CDOs

In this article, the authors describe how to determine the implied loss distribution of a credit portfolio from CDO tranche quotes.

Mon 17 Jul 2023

The Financial Heat Machine: Coupling With the Present Financial Crises

In this article, the author considers dynamics of financial markets as dynamics of expectations of people acting on them and discusses it from the point of view of phenomenological thermodynamics.

Mon 17 Jul 2023

Quantpedia Research Review - Issue 9

Issue 9 explores the importance of gold in investment portfolios, discusses the lack of standardization in ESG ratings, and discusses whether investors should systematically emphasize certain industries or countries to increase expected returns.

Mon 17 Jul 2023

Acadia’s Open-Source Risk Engine (ORE) - How its expanded functionality provides a real choice for firms

In this article, discover the Open-Source Risk Engine (ORE) - a standardized pricing and risk framework.

Fri 30 Jun 2023

A Mean-Square Approach to Constant Proportion Debt Obligations

In this paper, the authors show that the optimal leverage function for CPDOs in a mean-square sense coincides with the one used in practice.

Thu 22 Jun 2023

Gambler's Ruin

The term “gambler’s ruin” is used for a number of statistical ideas whose common denominator is predicting the eventual outcome of a series of repeated bets.

Thu 22 Jun 2023

Quantpedia Research Review - Issue 8

Issue 8 compares In-Sample vs. Out-of-Sample trading strategies, evaluates the Skewness Model in commodities, and explores how to rebalance smart beta strategies.

Thu 22 Jun 2023

From Within

In this article, Elie Ayache reviews the smile problem, explores how can it be interpreted and if people really understand it.

Fri 26 May 2023

Barrier Options and Lumpy Dividends

In this article, the authors study the pricing of barrier options on stocks with lumpy dividends.

Fri 26 May 2023

Quantpedia Research Review - Issue 7

Issue 7 explores equity factor models, discusses how political beliefs impact fund managers’ decisions, and reviews the new BERT large language model (LLM).

Thu 25 May 2023

Quant Insights Conference: How Quantum Should Change the Way We Think About Finance

In this panel discussion led by David Orrell, Principal, Systems Forecasting, participants Professor Andrew Sheng, Chief Advisor, China Banking and Insurance Regulatory Commission, Esperanza Cuenca-Gómez, Head of Strategy and Outreach, Multiverse Computing, and Dr. Taha Jaffer, Head of Wholesale Banking and Treasury AI, Scotiabank, share their views on the current quantum evolution in finance.

Mon 1 May 2023

Using Zweig’s Monetary and Momentum Models in the Modern Era

In this article, the author explores Mark Zweig's Monetary and Momentum Models and sees how well they work in our current markets with low interest rates and much programming and high-frequency trading.

Wed 19 Apr 2023

The Little Heston Trap

This article explains the properties and relations between the two versions of the characteristic function in the Heston model, which are solutions to a Riccati equation. This is important for addressing numerical issues caused by "branching" in finance, which has been amplified by the development of the general option pricing formula by Carr and Madan.

Wed 19 Apr 2023

Quantpedia Research Review - Issue 6

Issue 6 investigates different variance risk premium strategies, explores the role of gold as a crisis hedge, and tests ChatGPT’s abilities.

Wed 19 Apr 2023

Developments and Applications in Machine Learning in Portfolio Management

Read a summary of the panel discussion from the 2023 Portfolio Management in Quant Finance Conference.

Fri 14 Apr 2023

Quantpedia Research Review - Issue 5

Issue 5 explores ESG funds and greenwashing, reviews size factor as an investment choice and investigates price reaction around Bitcoin and Ethereum networks.

Thu 23 Mar 2023

The Fed Isn’t Federal – And Other Odd Things in Finance

In this paper, Rolf Poulson gives notice to misunderstandings in quantitative finance that range from amusing to genuine obstacles.

Thu 23 Mar 2023

Approximation of Continuous Monitoring with Discrete Monitoring Applied to Down—And—Out Options

In this paper, Stefan Ebenfeld and Damaris Hilzinger consider down—and—out options in the Black—Scholes framework.

Thu 23 Mar 2023

Quantitative Finance: Skills of the Future

Read the write-up from the February 2023 careers talk, 'Quantitative Finance: Skills of the Future'.

Mon 27 Feb 2023

Quantpedia Research Review - Issue 4

Issue 4 explores the use of quantum computers in finance, reviews Patent-to-Market trading strategies and discusses how the news impacts Bitcoin returns.

Wed 22 Feb 2023

Derivatives Technology as a Matter of Survival

This article explores the use of electronic banking of derivatives or investment products containing derivatives.

Tue 21 Feb 2023

Hedging under SABR Model

This article takes a fresh look at the delta and vega risks within the SABR stochastic volatility model Hagan et al. (2002).

Tue 21 Feb 2023

Do not Forget the Economy when Estimating Default Probabilities

Traditional rating systems do not include macroeconomic variables. This article shows techniques to integrate macroeconomic information into a rating model and then illustrates how the macroeconomic variables improve the performance of a model for small and medium sized companies.

Tue 17 Jan 2023

What Happened to Currency Fixings?

This article explores the manipulations of currency fixings and how the fixing production has been reshaped.

Tue 17 Jan 2023

Quantpedia Research Review - Issue 3

Issue 3 reviews post-earnings announcement drift, stock-bond correlation and the role of interest rates in factor discovery. Plus, learn how you can model a 100-year history of your portfolio.

Tue 17 Jan 2023

Is Crypto The Next Frontier Of Opportunities For Quants?

Read a summary of the panel discussion from the 2022 Annual Quant Insights Conference.

Thu 8 Dec 2022

Introduction to Variance Swaps

This article introduces the properties of variance swaps, and gives insights into the hedging and valuation of these instruments from the particular lens of an option trader.

Thu 1 Dec 2022

Quantpedia Research Review - Issue 2

Issue 2 reviews the hidden costs of ETFs and new findings on overnight sentiment trading. We also investigate if insider trading is still a problem, and explore possible approaches to multi-strategy portfolio management.

Thu 24 Nov 2022

Internal LGD Estimation in Practice

Peter Glößner, Achim Steinbauer, Vesselka Ivanova discuss loss given default (LGD) in this article.

Thu 17 Nov 2022

The Great Investors, Their Methods and How We Evaluate Them: Theory

This article discusses a categorization of the efficient market camps which is related to how various people try to get an edge.

Mon 7 Nov 2022

Communication Best Practices in Quantitative Finance

Ed Ma gave a recent talk on ‘Communication Best Practices in Quantitative Finance’ – find out more about his advice and top tips.

Sat 22 Oct 2022

Saints and Sinners: A Panel Discussion from the ESG and Climate Risk Conference

Read a summary of the panel discussion from the 2022 ESG and Climate Risk in Quant Finance Conference.

Sat 15 Oct 2022

Conference Summary: ESG & Climate Risk in Quant Finance

Read a summary of the ESG & Climate Risk in Quant Finance Conference.

Sat 15 Oct 2022

Pricing Credit Derivatives with Uncertain Default Probabilities

In this article, the author presents a model for pricing credit spread options in an environment where the rating transition probabilities are uncertain parameters.

Tue 11 Oct 2022

Quantpedia Research Review - Issue 1

Issue 1 delves into the detail on overnight market anomalies and combining data sources for the dollar factor. We also look into different replication approaches for ETFs, and review new thinking on market timing strategies.

Mon 10 Oct 2022

A Day in the Life of a Quantitative Portfolio Manager

CQF alumnus, Michael Althof gave a recent talk on ‘A Day in the Life of a Portfolio Manager’ – discover what he had to say about this career.

Fri 7 Oct 2022

The Chemistry of Contagious Defaults

In this article, the authors have obtained a dynamical Markovian model of default interactions that describes portfolio’s dynamics endogenously through the mechanism of chemical reactions.

Thu 1 Sep 2022

Trend followers lose more often than they gain

In this article, the authors solve exactly a simple model of trend following strategy, and obtain the analytical shape of the profit per trade distribution.

Thu 1 Sep 2022

Swaptions: 1 Price, 10 Deltas, and … 61/2 Gammas*

This article compares simple risk measures (first and second order sensitivity to the underlying yield curve) for simple instruments (swaptions).

Thu 1 Sep 2022

A Markovian Model of Default Interactions: Comments and Extensions

This article analyses Davis and Lo (2001b) enhanced risk model, which is a dynamic version of the popular market model of infectious defaults of Davis and Lo (2001a).

Thu 1 Sep 2022

Quant Insights Conference: Factor Investing and the Road to Diversified Serfdom

In May 2022, the Quant Insights Conference held by the CQF Institute featured a panel discussion entitled, “Factor Investing and the Road to Diversified Serfdom.”

Mon 15 Aug 2022

Can anyone solve the smile problem?

In this paper, the authors explore whether the smile problem can be solved and provide a general reflection of the problem.

Tue 31 May 2022

Knock-in/out Margrabe

In this paper, Espen G. Haug and Jorgen Haug push the Black-Scholes-Merton (BSM) formula to the limit by using it to value exchange-one-asset-for-another options with knock-in or knock-out provisions that depend on the ratio of the two asset prices.

Tue 31 May 2022

Stochastic Processes in Finance - Part II

This is the second article by Jörg Kienitz on stochastic processes in finance.

Thu 21 Apr 2022

Calibration problems – An inverse problems view

In this article, Heniz W. Engl discusses the model parameters from market prices of liquid instruments.

Thu 21 Apr 2022

Forecasting the Yield Curve with S-Plus

In this paper, Dario Cziráky, shows how to implement the Nelson-Siegel and Svensson models using non-linear least squares and how to obtain standard errors and confidence intervals for the parameters, which proves to be useful in assessing the goodness-of-fit at specific points in the term structure, such as at the events of non-parallel shifts.

Fri 4 Mar 2022

An Asymptotic FX Option Formula in the Cross Currency Libor Market Model

In this article, Atsushu Kawai and Peter Jäckel introduce analytic approximation formulae for FX options in the Libor market model (LMM). The method to derive the formulae is an asymptotic expansion technique introduced in Kawai [Kaw03].

Fri 4 Mar 2022

Rootless Vol

Kent Osband discusses the Brownian motion in this Wilmott article.

Tue 1 Feb 2022

Software Frameworks in Quantitative Finance, Part I Fundamental Principles and Applications to Monte Carlo Methods

In this Wilmott article, Daniel J. Duffy and Joerg Kienitz discuss a number of ongoing efforts when developing customizable software systems and frameworks for problems in Quantitative Finance.

Tue 1 Feb 2022

Building Your Wings on the Way Down

Aaron Brown discusses financial risk in this article from Wilmott Magazine.

Tue 4 Jan 2022

Amaranthus Extermino

What does the 2006 Amaranth Advisors natural gas hedge fund disaster tell us about the state of hedge funds?

Tue 4 Jan 2022

Introduction to Variance Swaps

The purpose of this article is to introduce the properties of variance swaps, and give insights into the hedging and valuation of these instruments from the particular lens of an option trader.

Tue 7 Dec 2021

Monte Carlo in Esperanto

This article shows how a simple parser environment in Excel/VBA could be used to perform single and multi-dimensional Monte Carlo.

Thu 4 Nov 2021

Numerical Methods for the Markov Functional Model

Some numerical methods for efficient implementation of the 1- and 2-factor Markov Functional models of interest rate derivatives are proposed.

Thu 4 Nov 2021

Order Statistics for Value at Risk Estimation and Option Pricing

We apply order statistics to the setting of VaR estimation. Here techniques like historical and Monte Carlo simulation rely on using the k-th heaviest loss to estimate the quantile of the profit and loss distribution of a portfolio of assets. We show that when the k-th heaviest loss is used the expected quantile and its error will be independent of the portfolio composition and the return functions of the assets in the portfolio.

Tue 12 Oct 2021

Pricing Rainbow Options

A previous paper (West 2005) tackled the issue of calculating accurate uni-, bi- and trivariate normal probabilities. This has important applications in the pricing of multiasset options, e.g. rainbow options. In this paper, we derive the Black—Scholes prices of several styles of (multi-asset) rainbow options using change-of-numeraire machinery. Hedging issues and deviations from the Black-Scholes pricing model are also briefly considered.

Tue 12 Oct 2021

Finformatics: How to Measure Really Small Things

The orthodoxy has tendency to ignore drift which leaves opportunity for finformaticians the market over…

Wed 15 Sep 2021

A VaR-based Model for the Yield Curve

An intuitive model for the yield curve, based on the notion of value-at-risk, is presented. It leads to interest rates that hedge against potential losses incurred from holding an underlying risky security until maturity. This result is also shown to tie in directly with the Capital Asset Pricing Model via the Sharpe Ratio. The conclusion here is that the normal yield curve can be characterised by a constant Sharpe Ratio, non-dimensionalised with respect to √T, where T is the bond maturity.

Wed 15 Sep 2021

Life Settlements and Viaticals

Life settlements and viaticals are contracts associated with death. Life settlements are a secondary market for the life insurance policies held by individuals. These individuals may, typically later in life, want to sell their policy. The policy is usually worth a lot more than its surrender value. Many of these life insurance policies are then usually packaged together and sold as one product. To the quant, the question is how to model and price, and hedge, individual policies and portfolios of policies.

Thu 5 Aug 2021

Valuation of American Call Options

The purpose of this paper is to provide an analytical solution for American call options assuming proportional dividends. Proportional dividends are more realistic for long-term options than absolute dividends and the formula does not have the flaws known from absolute dividend formulae.

Thu 5 Aug 2021

Poker as a Lottery

Doyle Brunson, two-time winner of the World Series of Poker main event, has likened a poker tournament to a lottery in which more skilled players (like himself) hold more tickets than less skilled players. This article works out the details of this analogy and provides some very general and very important results for anyone hoping to be a winning poker player.

Thu 8 Jul 2021

A Conditional Valuation Approach for Path-Dependent Instruments

This paper focuses on the methodology for calculating the potential future exposure of path-dependent derivative instruments.

Thu 8 Jul 2021

Scenarios IV: Planning for Disasters and then Dealing with them

In the aftermath of Katrina, Bill Ziemba discusses planning for the economic and financial effects of natural disasters.

Tue 22 Jun 2021

Monte Carlo Methods in Quantitative Finance Generic and Efficient MC Solver in C++

This paper describes how the authors have designed and implemented a software architecture in C++ to model one-factor and multifactor option pricing problems.

Tue 22 Jun 2021

A Generalised Procedure for Locating the Optimal Capital Structure

This article presents a generalisation of an earlier approach for determining and locating the optimal capital structure of a corporate firm.

Thu 8 Apr 2021

Six Degrees of Idiocy

One of the classic works of poker, and risk management, is Herbert Yardley’s 1957 best-seller 'The Education of a Poker Player, Including Where and How One Learns to Win'. Aaron Brown explores how in both poker and finance an individual’s strategic idiocy can be quantified and analyzed.

Thu 8 Apr 2021

Not-so-Complex Logarithms in the Heston Model

In Heston’s stochastic volatility framework [Heston 1993], semi-analytical formulæ for plain vanilla option prices can be derived. Unfortunately, these formulæ require the evaluation of logarithms with complex arguments during the involved inverse Fourier integration step. In this article, a new approach is proposed to solve this problem which enables the use of Heston’s analytics for practically all levels of parameters and even maturities of many decades.

Fri 5 Mar 2021

Arbitrage-Free CMS Valuation - Watch out for the Correlations

CMS swaps (and other derivatives such as CMS caps or spread options) have become increasingly popular products in fixed-income markets. However, although a number of standard valuation formulas for CMS products exist, they very often include approximations or assumptions.

Fri 5 Mar 2021

Option Pricing and the Dirichlet Problem

Laplace’s equation is ubiquitous in physics. Yet, despite the equation’s importance in physics, it has not been important so far in finance. In this article, Joshi will relate it to options’ pricing.

Mon 8 Feb 2021

A Mathematician on Wall Street: Berkshire Hathaway

From a cigar butt to a humidor full of Havanas, courtesy of Mr Buffett with Ed Thorp.

Mon 8 Feb 2021

Stochastic Processes in Finance - Part I

This Wilmott article by Jörg Kienitz covers the key concepts of the theory of stochastic processes used in finance.

Tue 1 Dec 2020

The Irony In The Derivatives Discounting

In this Wilmott article, Marc Henrard discusses the impact on derivative pricing of changing the discounting curve.

Tue 1 Dec 2020

CSA Caps Convexity Impact on Hull & White Calibration

Papaioannou shows how modeling jointly OIS and LIBOR using one factor guassian short rate dynamics allows to capture CSA-convexity on caps and measures its impact on LIBOR volatility calibration in the Hull & White case.

Mon 26 Oct 2020

It’s the Debt, Stupid

Increasingly, Bogni feels, at least at a personal level, forced into the role of defender of financial innovation against the hordes of financial luddites. Interestingly, the turning point was not the equity-fuelled dotcom bubble at the turn of the millennium, but the debt bubble that finally burst with the Lehman Brothers debacle.

Mon 21 Sep 2020

What I Knew and When I Knew It - Part 2

Mathematician, Ed Thorp, looks back to the creation of the world's first market-neutral hedge fund and pre-empting Black-Scholes.

Tue 25 Aug 2020

Sequential Modeling of Dependent Jump Processes

In this article published by WIlmott magazine, Mai, Scherer, and Schulz present a new methodology to generalize univariate models to the multivariate case.

Mon 20 Jul 2020

Derivatives Pricing and Trading in Incomplete Markets: A Tutorial on Concepts

In this article published by the Wilmott magazine, Dennis Yang illustrates various derivative pricing notions in incomplete markets using a simple example, with emphasis on how to use these pricing concepts to make systematic trading decisions.

Mon 29 Jun 2020

Bridge with Buffett

“Investing in a market where people believe in efficiency is like playing bridge with someone who has been told it doesn’t do any good to look at the cards.” – Warren Buffett

Fri 19 Jun 2020

The Irony in the Variance Swaps

In this article published by Wilmott magazine, Elie Ayache will propose a rereading of quantitative finance where irony, as opposed to theory, emerges as a leitmotiv, perhaps even a main guide.

Fri 29 May 2020

Sensible Sensitivities for the SABR Model

In this article published by the Wilmott magazine, Chibane, Miao and Xu develop a new methodology for computing smile sensitivities (Vegas) for European securities priced under the SABR model when the latter is calibrated to more market volatilities than the number of available model parameters.

Tue 19 May 2020

How the rise in data has led to a skills gap

The exponential growth in data is driving companies to look at how they can use new insights to their competitive advantage. Managing and analysing this increasing volume of data, using strategies such as AI and machine learning, has opened up significant skill gaps in the financial services sector. Which is where digital learning has a big role to play.

Tue 19 May 2020

Inefficient Markets

In this article published by the Wilmott magazine, Ed Thorp discusses the "crash of 87", the most extreme stock market price jump of the twentieth century.

Tue 12 May 2020

The End of Growth?

In this article published by the Wilmott magazine, former banker and author, Satyajit Das, asks if this is the end of economic growth and what a world of no, or low rates of, growth will look like.

Tue 21 Apr 2020

Fitch Learning Aims to Boost AI & Machine Learning Skills in China

Hong Kong – 30 March 2020: A record number of professionals have signed up for Fitch Learning’s quantitative finance programme to

Mon 30 Mar 2020

Potential Future Exposure Calculations Using the BGM Model

Within this paper the authors look at the BGM model in PFE calculations for various exotic interest rate products.

Thu 18 Jul 2019

Managing Smile Risk

In this paper, it is discovered that the dynamics of the market smile predicted by local vol models is opposite of observed market behaviour.

Sun 13 Jan 2019

How to Succeed in Quant Investing with Big Data Analytics

In this article, Peter Hafez shares his views on what he believes is required to succeed in today's world of quant investing.

Wed 12 Sep 2018

Transformers

In this column published in Wilmott Magazine, Mike Staunton discusses the Hilbert transform.

Tue 13 Feb 2018

Investing in Thoroughbred Race Horses

Bill Ziemba discusses the horse-racing investments at the highest level: actual horse ownership, as opposed to betting on the races.

Wed 24 Jan 2018

Bond over Big Data - Trading bond futures (& FX) with RavenPack news data

The author uses the RavenPack Analytics Global Macro data to create news-based economic indices (NBESI) for the U.S., E.Z, U.K. and Japan which they then test against sovereign bond futures prices.

Thu 12 Oct 2017

A “Multi-Topics” Approach to Building Quant Models

In this research, RavenPack demonstrate how their improved event detection technology allow investors to systematically identify key topics and market-moving events.

Thu 12 Oct 2017

Boris Johnson, Yanis Varoufakis And Sir Vince Cable All Have Something In Common

In Dr. Paul Wilmott's latest blog post he highlights what Boris Johnson, Yanis Varoufakis and Sir Vince Cable all have in common as they give their views on Brexit.

Mon 25 Sep 2017

IMPACT STUDY: Earnings Sentiment Consistently Outperforms Consensus

In RavenPack’s latest research, we find that their new earnings sentiment indicator derived from real-time news and social media significantly outperforms consensus estimates.

Tue 12 Sep 2017

How to use Natural Language Processing for Multi-Topic Quant Investing

In this article, Peter Hafez discusses how investors need the right tools to cut through the noise to uncover the signal behind the latest move in the markets.

Wed 23 Aug 2017

Navigating Stock Market Crashes in the Brexit Trump Era (Presentation Slides)

Presentation slides for Dr. Bill Ziemba's talk - 'Navigating Stock Market Crashes in the Brexit Trump Era'.

Wed 31 May 2017

Shiny New Toys: Does Wealth Management Need A.I.?

In this article, Greg Davies examines the allure of adopting artificial intelligence as a solution for a range of business problems in Wealth Management and the need to appropriately match solutions to problems.

Tue 30 May 2017

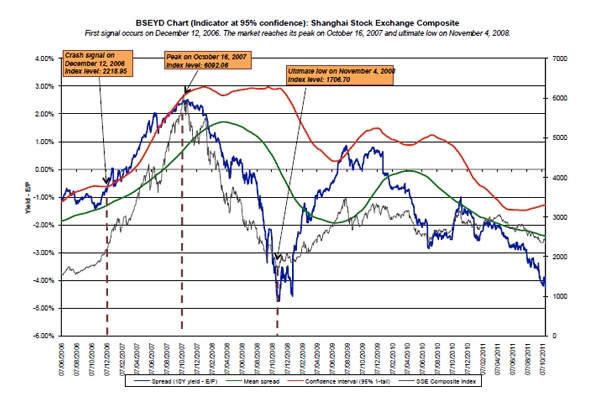

Stock Market Crashes in 2007 - 2009: Were We Able to Predict Them?

In this article, Sebastien Lleo and William T. Ziemba investigate the stock market crashes in China, Iceland and the US in the 2007 - 2009 period.

Mon 27 Mar 2017

A Tale of Two Indexes Predicting Equity Market Downturns in China

Sebastien Lleo and William T. Ziemba investigate whether traditional crash predictors, predicts crashes for the Shanghai Stock Exchange Composite Index and the Shenzhen Stock Exchange Composite Index.

Mon 20 Mar 2017

Sell in May and Go Away in the Equity Index Futures Markets

Constantine Dzhabarov and William T. Ziemba explain when the best time is to sell in the index futures markets.

Mon 13 Mar 2017

Index-tracking Portfolio Optimization Model

In the present tutorial report Guillermo Navas-Palencia examines the theory and computational aspects behind the index-tracking portfolio optimization model.

Thu 24 Nov 2016

Intellectual Property Law: A Briefing for Quants

In this article Barbara Mack gives a briefing for Quants on the Intellectual Property Law, covering the U.S. intellectual property regime, and the four types of protectable assets: copyright, trademark, trade secret and patent.

Fri 23 Sep 2016

Pricing Bermudan Swaptions on the LIBOR Market Model

In this article, Stef Maree and Jacques du Toit examine using the Stochastic Grid Bundling Method to price a Bermudan swaption driven by a one-factor LIBOR Market Model.

Mon 12 Sep 2016

Mathematics in Finance – The Unfair Advantage

In this article, Dr. Riaz Ahmad explains how finance continues to benefit from the effect of mathematics and gives it an unfair advantage.

Thu 4 Aug 2016

Explorations in Asset Returns

In this white paper CQF faculty member Dr. Richard Diamond provides an in-depth exploration in asset returns.

Sun 24 Jul 2016

Portfolio Credit Risk: Introduction

This technical report from nag examines the main theoretical aspects in models used in Portfolio credit risk.

Thu 2 Jun 2016

Paul Wilmott's Blog: The Only Question You Need to Ask About the EU Referendum

CQF founder Dr. Paul Wilmott has his say on the upcoming EU Referendum in the UK.

Thu 21 Apr 2016

The Swiss Black Swan Bad Scenario: Is Switzerland Another Casualty of the Eurozone Crisis?

In this paper Dr. Sébastien Lleo and Dr. William T. Ziemba discuss the Swiss Black Swan Bad Scenario and who the winners and losers are.

Wed 29 Jul 2015

Can Warren Buffett Also Predict Equity Market Downturns?

In this paper, Dr. Sébastien Lleo and Dr. William T. Ziemba investigate whether this ratio is a statistically significant predictor of equity market downturns.

Thu 23 Jul 2015

Review of the For Python Quants Conference

CQF delegate Barbara Mack, shares her thoughts on the 2015 For Python Quants Conference in New York.

Mon 15 Jun 2015

An Introduction to Quantitative Finance

In this article, Dr. Randeep Gug, gives a brief introduction to quantitative finance.

Tue 2 Jun 2015

Backtesting Trading Strategies Using Wolfram Finance Platform

This white paper explores one possibility for evaluating portfolio performance using the Wolfram Finance Platform, describing it's thought process.

Wed 29 Apr 2015

The Honest Truth about Dishonesty: Market Manipulation and Why Some Strings are More Powerful than Others

This short piece by Edward Talisse looks at the ways in which financial institutions and individuals have manipulated the market over the years and what it means for the future.

Fri 24 Apr 2015

Local Volatility FX Basket Option on CPU and GPU

In this article, Jacques du Toit and Isabel Ehrlich study a basket option written on 10 FX rates driven by a 10 factor local volatility model.

Wed 8 Apr 2015

Risk Management: A Review

Dr. Sébastien Lleo presents CQF Institute members with his review in Risk Management.

Wed 1 Apr 2015

CUDA Programming Using Wolfram Finance Platform

This document describes the benefits of CUDA integration in Wolfram Finance Platform and provides some applications for which it is suitable.

Wed 25 Mar 2015

The Meerkat Effect: Personality and Market Returns Affect Investors’ Portfolio Monitoring Behavior

In this article the authors apply generalised non-linear mixed effects models to test for this selective information monitoring at an individual level in a new sample of active online investors.

Mon 9 Mar 2015

Black-Litterman in Continuous Time: The Case for Filtering

Dr. Mark Davis and Dr. Sébastien Lleo extend the Black–Litterman approach to a continuous time setting.

Fri 13 Feb 2015

Solving partial differential equations using the NAG Library

In this article, Jeremy Walton from the Numerical Algorithms Group, describes some applications of the NAG Library to the solution of Partial Differential Equations (PDEs).

Thu 12 Feb 2015

Excerpt from a chapter on High Frequency Trading in The World Scientific Handbook of Futures Markets

In this short piece from a chapter in The World Scientific Handbook of Futures Markets, Barbara Mack presents an overview on HFT, case studies, and a summary of select regulations in the United States.

Wed 28 Jan 2015

Ferdinand the Bull

In his latest commentary, Edward Talisse likens the financials and banks to that off a bull, and explains where it all went wrong in the 2008 financial crisis.

Wed 1 Oct 2014

Dead on Arrival - Living Wills and Liquidity

With surprisingly little fanfare, the Federal Reserve and other prudential regulators completely rejected the ‘Living Wills’ submitted by eleven of the largest U.S. Bank Holding Companies (BHCs).

Thu 4 Sep 2014

The Price is Right - The S&P 500 Index Deconstructed

Is the widely followed S&P 500 equity index wildly overvalued at its current price of 2,000?

Thu 4 Sep 2014

Asset Shortage

The difference between the amount or stock of assets outstanding and its tradable flow adjusted float is rarely discussed by research analysts and advisors.

Thu 4 Sep 2014

Timing the Bond Market

Edward Talisse, gives his view on stock-bond correlation in his latest article where he advises the best timing to invest bonds.

Wed 3 Sep 2014

Financials and Bank Performance. Plus an 18 Month Forecast.

Edward Talisse gives a comprehensive financials and bank performance overview of 2014 so far, plus an 18 month forecast.

Fri 8 Aug 2014

Anything Built By the FED, Can Also Be Destroyed

In this commentary, Edward Talisse examines the year’s bond investment, looking closely at the USA and countries in Europe including Spain, Italy and Greece.

Wed 30 Jul 2014

Hands Off My Cash, Monty

In this article, Edward Talisse examines how index investing captures the market's beta (systematic risk) premium in particular asset classes.

Tue 22 Jul 2014

Road Kill

In this article Edward Talisse discusses his time working around the world in market trading. He gives his views on the current state of the global financial markets and what lies ahead for the future.

Tue 15 Jul 2014

The Tide is High

In this article, Edward Talisse delivers another commentary on the state of the American financial markets.

Fri 11 Jul 2014

Geezers Need Excitement: Trading Jitters and the Volume Myth

Declining trading volumes is a fact. But the idea that high volume is good and low volume is bad is a fallacy. In this article, Ed Talisse looks at 5 market shocks that are driving trading volumes lower.

Tue 1 Jul 2014

High Frequency Trading - Innovation or Rigging?

In this article, Edward Talisse asks the question; Are technological savvy and speedy traders bad for the long-term health of financial markets?

Mon 16 Jun 2014

Does the Bond-Stock Earning Yield Differential Model Predict Equity Market Corrections Better Than High P/E Models?

In this paper, Dr. Sébastien Lleo and Dr. William Ziemba extend the literature on crash prediction models in three main respects.

Thu 5 Jun 2014

Volcker Rule - A Whale with a Cigar

Edward Talisse discusses what the implications could mean for the impending Volcker Rule and what the outcome will be on fixed income and foreign exchange trading desks.

Tue 8 Apr 2014

Identifying Business Cycles Using RLink in Wolfram Finance Platform

In this white paper, Wolfram demonstrate the use of RLink by identifying business cycles that affect stock markets for periods generally lasting about four years.

Fri 4 Apr 2014

Financial Option Prices in Excel

In this article, both Marcin and Jeremy discuss the use of algorithms from the NAG Library to calculate prices for financial options.

Fri 4 Apr 2014

Exact First- and Second-Order Greeks by Algorithmic Differentiation

In this article, The Numerical Algorithms Group (NAG) work very closely with Uwe Naumann to help users take advantage of Algorithmic Differentiation methods.

Fri 4 Apr 2014

Democratization of Hedge Funds and Alternatives

In this article, Kristoffer Houlihan offers some advice for private clients and family offices entering the hedge fund investment space, and some practical considerations when evaluating an emerging manager.

Fri 4 Apr 2014

VaR as a Percentile

In this white paper Dr. Richard Diamond expands on the concept of Value at Risk (VAR) from a formula based on the critical value, to its true definition of being a property of the joint probability distribution of risk factors.

Fri 4 Apr 2014